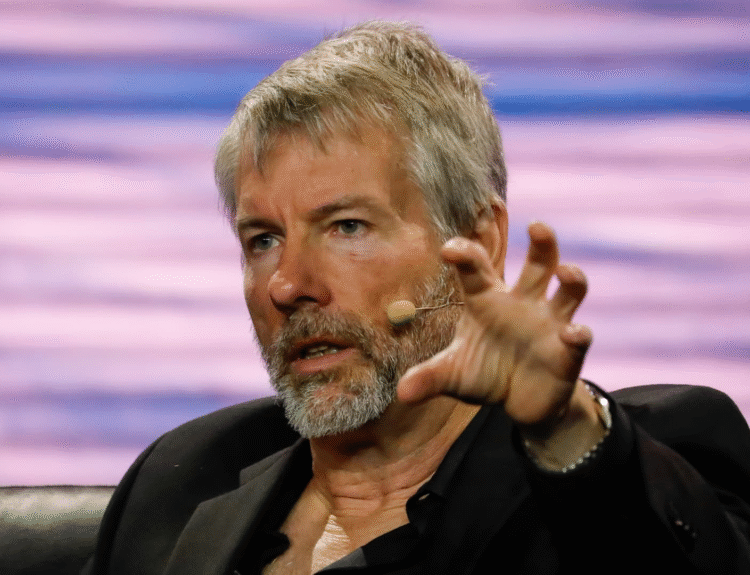

Last week, as Bitcoin flirted with the tantalizing $100,000 mark, something interesting happened: Strategy, led by Bitcoin evangelist Michael Saylor, seemed to tap the brakes on their aggressive BTC buying spree. Simultaneously, Semler Scientific quietly ramped up their crypto investments. It got me thinking, what’s behind these contrasting strategies?

Strategy’s Cautious Approach

Strategy, known for its massive Bitcoin holdings, acquired 1,895 BTC for $180.3 million between April 28 and May 4, at an average price of $95,167 per Bitcoin, according to their recent SEC filing. While still a significant purchase, it’s noticeably smaller compared to some of their earlier acquisitions this year. This makes me wonder, is Saylor becoming more cautious as Bitcoin approaches new heights? Maybe he sees a potential pullback or is simply diversifying their treasury strategy.

According to data from BitcoinTreasuries.net, Strategy currently holds over 214,000 BTC, making them the largest corporate holder of Bitcoin. Their conviction in Bitcoin as a store of value is clear, but this recent slowdown suggests a nuanced approach to market volatility. Perhaps they’re waiting for a more favorable entry point or re-evaluating their risk tolerance at these elevated price levels. It’s also important to note that while this specific week saw a smaller purchase, Strategy’s overall commitment to Bitcoin remains substantial. They’ve consistently added to their holdings, showcasing a long-term belief in its potential.

Semler Scientific’s Bold Move

On the other hand, Semler Scientific, a company focused on providing technology solutions for healthcare providers, seems to be embracing Bitcoin with open arms. While specific details of Semler’s purchase weren’t in this particular article, the contrast with Strategy’s behavior highlights a broader trend: increased institutional interest in Bitcoin beyond the usual suspects. It makes you wonder who else is quietly accumulating BTC behind the scenes.

Semler’s move could be interpreted as a sign of confidence in Bitcoin’s long-term prospects, viewing it as a hedge against inflation or a strategic asset for their balance sheet. As more companies explore Bitcoin as part of their treasury management, it will be interesting to see if this trend continues and how it impacts Bitcoin’s price stability.

The Bigger Picture: Institutional Adoption and Market Dynamics

These contrasting moves by Strategy and Semler illustrate the complex dynamics at play in the Bitcoin market. While Strategy may be exercising caution, Semler’s increased investment underscores the growing acceptance of Bitcoin as a legitimate asset class. Institutional adoption is a key driver of Bitcoin’s price and stability, and these types of moves demonstrate the diverse strategies institutions are using to engage with crypto.

I think that institutional interest in Bitcoin will only continue to grow, especially as regulatory clarity improves and more traditional financial institutions offer crypto-related services. The future success of Bitcoin will depend on continued adoption by both retail and institutional investors.

Key Takeaways:

- Institutional Strategies Vary: Strategy’s slowed purchases contrast with Semler’s increased investment, showcasing diverse approaches to Bitcoin.

- Market Volatility Influences Decisions: Bitcoin’s near-$100,000 price likely prompted Strategy’s caution.

- Growing Institutional Adoption: Semler’s move highlights the increasing acceptance of Bitcoin as an asset class.

- Long-Term Belief Remains: Despite short-term fluctuations, Strategy’s overall Bitcoin holdings demonstrate long-term conviction.

- Regulation & Acceptance are Key: Further institutional adoption hinges on regulatory clarity and traditional financial integration.

FAQs:

- Q: Why did Strategy slow down their Bitcoin purchases?A: It’s likely due to the high price of Bitcoin and a potential re-evaluation of their risk tolerance.

- Q: What does Semler’s investment signify?A: It signals growing institutional confidence in Bitcoin as a strategic asset.

- Q: How does institutional adoption affect Bitcoin’s price?A: Increased institutional participation generally leads to greater price stability and potential appreciation.

- Q: Is Strategy still bullish on Bitcoin?A: Yes, their continued Bitcoin holdings demonstrate a long-term belief in its value, despite recent slowed purchases.

- Q: What factors could hinder further institutional adoption?A: Lack of regulatory clarity and integration with traditional financial systems are key challenges.

“`