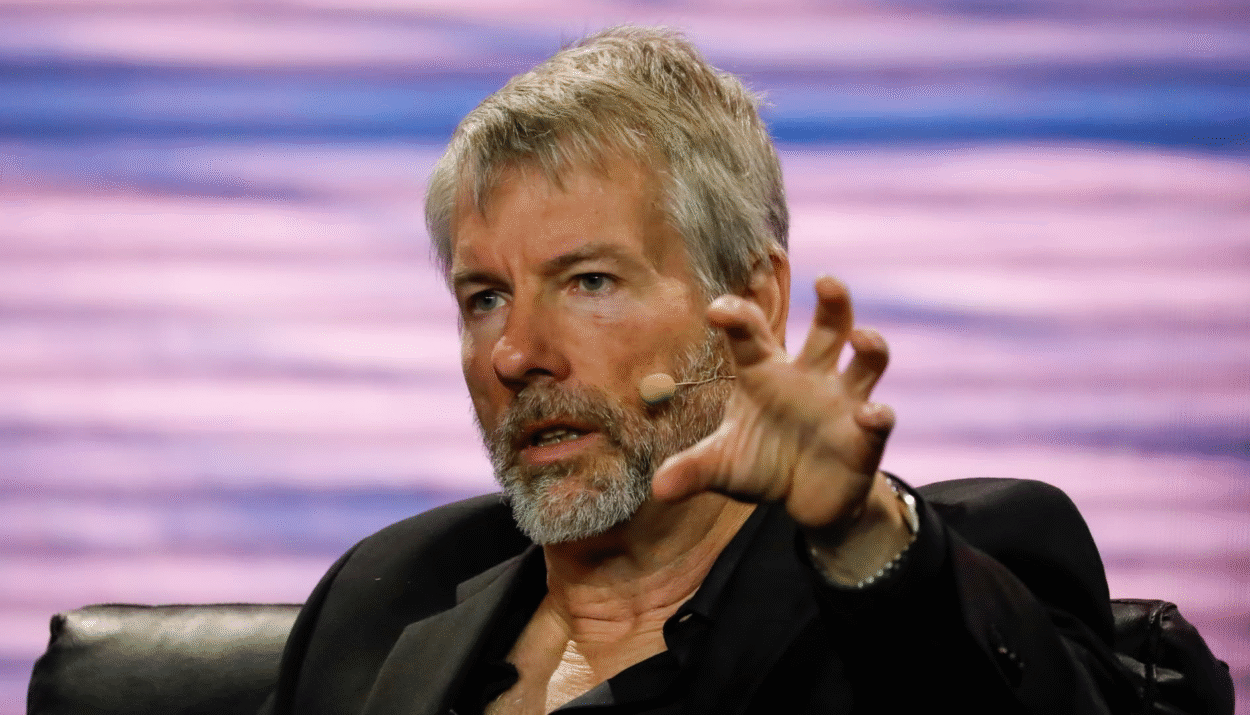

Alright, let’s talk Bitcoin. I stumbled across a fascinating Coindesk article detailing MicroStrategy’s latest move in the crypto space, and it’s got me thinking. Michael Saylor’s company just scooped up another 1,895 Bitcoin, boosting their total holdings to a staggering 555,450 BTC. This isn’t just pocket change; it’s a significant accumulation that warrants a closer look.

Funding the Future: How MicroStrategy Buys Bitcoin

The real kicker, in my opinion, is how they’re funding these massive purchases. According to the article, this latest buy was fueled by a combination of sales of common stock and STRK preferred stock. It’s a strategic play, using traditional financial instruments to acquire a digital asset. It makes you wonder if this is becoming the new normal for corporate Bitcoin accumulation. As of Q1 2024, MicroStrategy’s reports indicated aggressive capital raising strategies explicitly for Bitcoin acquisition, highlighting the commitment Saylor has to his Bitcoin strategy.

STRK: A New Player in the Game?

STRK preferred stock is something to keep an eye on. Its inclusion in the funding mix suggests MicroStrategy is diversifying its capital-raising methods, possibly tapping into different investor pools interested in crypto exposure but through more conventional investment vehicles. This could be a smart move to mitigate risk and attract investors who are crypto-curious but hesitant to dive straight into the deep end.

The Bigger Picture: MicroStrategy’s Bitcoin Dominance

Let’s be honest, MicroStrategy’s Bitcoin strategy isn’t without its critics. However, their continued accumulation sends a strong signal about Saylor’s long-term vision for Bitcoin. Holding over 555,450 BTC positions MicroStrategy as a major player in the Bitcoin ecosystem. To put that into perspective, that’s roughly over 1% of the total Bitcoin that will ever exist! Data from Bitcoin Treasuries shows MicroStrategy holds a significant lead compared to other publicly traded companies. Their conviction is a beacon to other institutions, hinting at the potential of Bitcoin as a treasury reserve asset.

Is This a Sustainable Strategy?

Of course, the million-dollar question (or should I say, the million-Bitcoin question) is whether this strategy is sustainable. It hinges on Bitcoin’s price appreciation, and while past performance is no guarantee of future results, Saylor’s bet seems to be paying off so far. The risk, obviously, lies in a potential Bitcoin crash, which could significantly impact MicroStrategy’s balance sheet. However, Saylor seems to be playing the long game, betting that Bitcoin’s value will continue to rise over time.

Implications for the Crypto Market

MicroStrategy’s continued Bitcoin accumulation has broader implications for the entire crypto market. It demonstrates institutional interest in Bitcoin and reinforces its narrative as a store of value. This can, in turn, attract more investors, both retail and institutional, further legitimizing Bitcoin as an asset class. Moreover, MicroStrategy’s strategy could inspire other companies to follow suit, potentially leading to a supply squeeze and driving up the price of Bitcoin. Recent reports highlight a growing trend of institutional adoption of Bitcoin, and MicroStrategy is undoubtedly leading the charge.

Will Other Companies Follow Suit?

That’s the big question. If MicroStrategy’s strategy continues to be successful, we might see more companies adding Bitcoin to their balance sheets. This could create a positive feedback loop, driving up demand and further validating Bitcoin’s role in the global financial system. However, regulatory uncertainties and the inherent volatility of Bitcoin remain significant hurdles for many corporations.

Key Takeaways from MicroStrategy’s Bitcoin Strategy:

- Aggressive Accumulation: MicroStrategy is not slowing down in its Bitcoin acquisition strategy.

- Innovative Funding: They are using creative methods, including STRK preferred stock, to fund their Bitcoin purchases.

- Long-Term Vision: Saylor clearly believes in Bitcoin’s long-term potential as a store of value.

- Market Influence: MicroStrategy’s actions have a significant impact on the overall crypto market sentiment.

- Institutional Adoption: Their strategy could pave the way for more corporate adoption of Bitcoin.

Frequently Asked Questions

How does MicroStrategy benefit from holding Bitcoin?

MicroStrategy believes Bitcoin is a superior store of value compared to traditional assets like cash. They anticipate long-term appreciation in Bitcoin’s price, which will increase the value of their holdings.

What are the risks of MicroStrategy’s Bitcoin strategy?

The primary risk is the volatility of Bitcoin. A significant drop in Bitcoin’s price could negatively impact MicroStrategy’s financial performance and investor confidence.

Could other companies adopt a similar Bitcoin strategy?

Yes, it’s possible. However, factors such as regulatory uncertainty, risk tolerance, and shareholder approval would need to be considered.

What is STRK preferred stock?

STRK preferred stock is a type of stock that gives MicroStrategy more flexibility in raising capital for Bitcoin purchases. Details about STRK are limited in the provided context, but it indicates a diversified funding approach.

Where can I find more information about MicroStrategy’s Bitcoin holdings?

You can find updates on MicroStrategy’s investor relations website and in their quarterly earnings reports.

“`