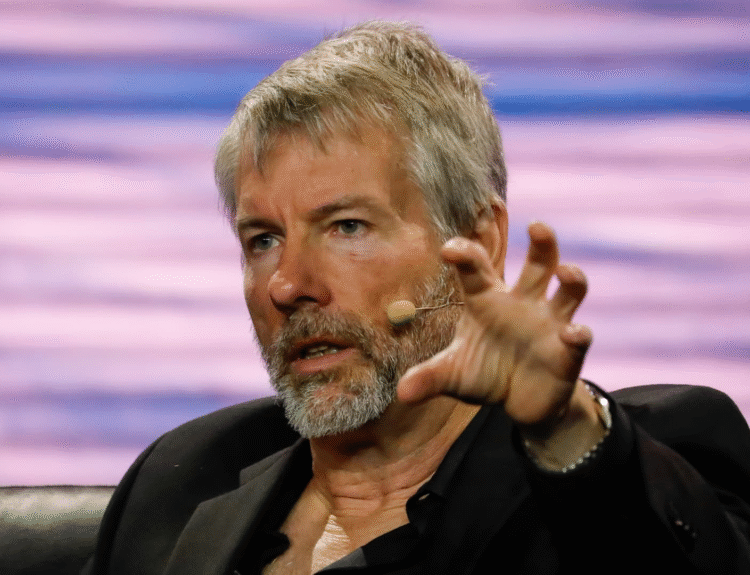

So, I stumbled across an interesting article on Cointelegraph that got me thinking. The piece talks about how Michael Saylor, a big Bitcoin advocate, suggests that Apple adding Bitcoin to its balance sheet could potentially give their stock a much-needed boost.

Apple, as we know, loves its stock buybacks. They’ve spent billions repurchasing their own shares, aiming to drive up the stock price. But lately, things haven’t been going as planned. The stock hasn’t exactly been on a rocket ship, and Saylor believes Bitcoin could be the missing piece.

Now, I know what you might be thinking: “Apple and Bitcoin? That’s a weird combo!” But hear me out.

Apple is sitting on a mountain of cash. In fact, as of their last earnings report, they had nearly $162 billion in cash and marketable securities. Source: Apple Q2 2024 Earnings Report Traditionally, companies invest this cash in low-risk assets like government bonds. But these offer relatively low returns, especially in the current economic climate.

Here’s where Bitcoin enters the picture. Saylor’s argument, as I understand it, is that a small allocation of Apple’s massive cash reserves to Bitcoin could potentially generate significantly higher returns than traditional investments. Think of it as diversifying their treasury, but with a potentially much larger upside.

Look at MicroStrategy, Saylor’s company. They’ve made Bitcoin a core part of their treasury strategy, and while it’s been a volatile ride, their stock price has generally reflected Bitcoin’s performance. Some reports suggest MicroStrategy holds about 214,400 Bitcoins. Source: BitcoinTreasuries.net

Of course, this idea isn’t without its risks. Bitcoin is known for its volatility. A sudden price drop could negatively impact Apple’s balance sheet and investor confidence. Plus, regulatory uncertainty around cryptocurrencies remains a concern.

But, let’s be real: Apple is known for its innovative spirit. A bold move into Bitcoin could signal to the market that they’re willing to embrace new technologies and explore alternative investment strategies. It could also attract a new wave of investors who are keen on both tech and crypto.

5 Key Takeaways

- Stock Buybacks Aren’t Always Enough: Apple’s massive stock buybacks haven’t been a guaranteed fix for their stock performance.

- Bitcoin as a Treasury Asset: The idea of using Bitcoin as part of a company’s treasury strategy is gaining traction, as demonstrated by MicroStrategy.

- Potential for Higher Returns: Bitcoin offers the potential for higher returns compared to traditional low-risk investments.

- Risk vs. Reward: Any investment in Bitcoin would need to be carefully considered, weighing the potential risks against the potential rewards.

- Innovation Signal: A move into Bitcoin could be seen as a signal of innovation and forward-thinking by Apple.

In Conclusion:

While the idea of Apple adding Bitcoin to its balance sheet might seem unconventional, it’s an interesting thought experiment. It highlights the evolving landscape of corporate finance and the increasing interest in cryptocurrencies as potential investment assets. Whether Apple will actually take the plunge remains to be seen, but it’s definitely a conversation worth having.

FAQs About Apple, Bitcoin, and Corporate Finance

-

Why does Apple do stock buybacks?

Apple does stock buybacks to reduce the number of outstanding shares, which can increase earnings per share and potentially boost the stock price. -

What are the risks of Apple investing in Bitcoin?

The main risks include Bitcoin’s price volatility, regulatory uncertainty, and potential reputational risk if Bitcoin’s value declines significantly. -

How much of its cash reserves could Apple realistically allocate to Bitcoin?

This is speculative, but a small percentage (e.g., 1-5%) of their cash reserves could be a starting point, allowing them to test the waters without excessive risk. -

What other companies have invested in Bitcoin?

Besides MicroStrategy, companies like Tesla and Block (formerly Square) have also invested in Bitcoin. -

What are the potential benefits for Apple shareholders if Apple invests in Bitcoin?

Potential benefits include higher returns on investment, increased investor interest, and a signal of innovation and forward-thinking. -

How would Apple account for Bitcoin on its balance sheet?

Bitcoin would likely be accounted for as an intangible asset, subject to impairment rules if its value declines below the purchase price. -

What are some alternative investment strategies Apple could consider?

Alternatives include investing in other companies, research and development, or increasing dividends to shareholders. -

How could regulatory changes affect Apple’s potential Bitcoin investment?

Increased regulation could either legitimize Bitcoin as an asset class or impose restrictions that make it less attractive for corporate investment. -

What impact would a Bitcoin investment have on Apple’s ESG (Environmental, Social, and Governance) score?

It could negatively impact their ESG score due to concerns about Bitcoin’s energy consumption, although this is improving with the rise of more sustainable mining practices. -

Is it likely that Tim Cook, Apple’s CEO will consider a BTC investment in the future?

Currently, it is a matter of speculation. As digital assets and regulation evolve, the CEO could revisit the viability of this investment.