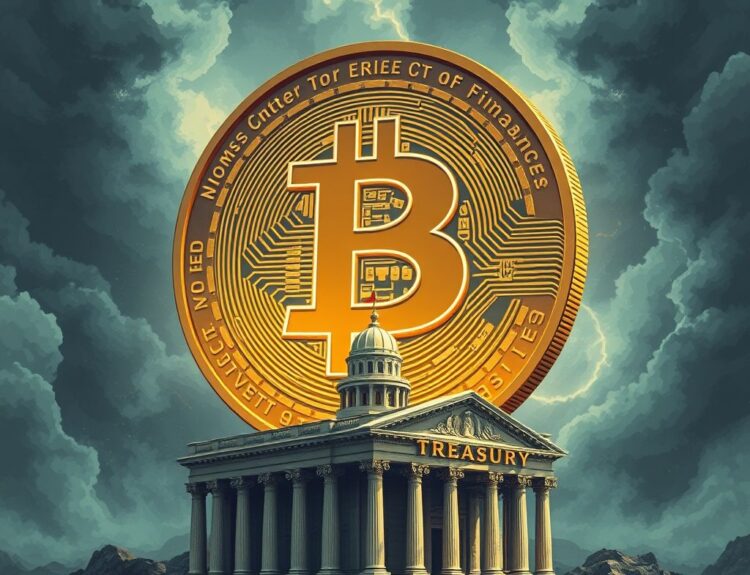

Alright crypto enthusiasts, let’s talk Bitcoin. Lately, I’ve been digging into how macroeconomic events, specifically Federal Reserve meetings, can send ripples through the crypto market. The buzz is that Bitcoin could potentially slide down to $60,000 as traders anxiously await the latest Fed announcement. Here’s my take on what’s happening, why, and what we should be watching.

The Fed Factor: Why Bitcoin Traders Are on Edge

So, why all the fuss about a Fed meeting? Well, the Federal Reserve controls the monetary policy of the United States, and its decisions have a HUGE impact on all markets, including crypto. When the Fed signals a hawkish stance – meaning they’re likely to raise interest rates or keep them high – it generally leads to investors pulling back from riskier assets like Bitcoin. Higher interest rates make borrowing more expensive, which can reduce overall investment and spending.

The current expectation is that the Fed will hold rates steady at this meeting. However, the real kicker is what they say about the future. Any hints about potential rate cuts or economic projections will be heavily scrutinized. According to a recent CME FedWatch Tool, market participants are closely monitoring these clues to anticipate the Fed’s next move.

Consider this: historical data shows a correlation between Fed rate hikes and Bitcoin price dips. For example, during the rate hike cycle of 2022, we saw significant volatility and downward pressure on BTC. While correlation doesn’t equal causation, it’s a pattern worth noting.

Potential Scenarios and Market Reactions

Let’s break down the possible scenarios:

- Scenario 1: Dovish Signals (Rate Cuts Hinted) – This could be positive for Bitcoin. Investors might see it as a sign of easier monetary policy, leading to increased risk appetite and potentially pushing BTC higher.

- Scenario 2: Hawkish Signals (Rates to Stay High Longer) – This is the scenario that could send Bitcoin lower. Uncertainty and risk aversion could trigger a sell-off, potentially leading to that $60,000 level.

- Scenario 3: Neutral Stance (No Clear Direction) – In this case, expect continued volatility and choppy trading as the market digests the information and tries to guess the Fed’s next move.

Decoding the $60K Target: Is It Realistic?

The prediction of Bitcoin sliding to $60,000 isn’t just pulled out of thin air. It likely stems from a combination of technical analysis, market sentiment, and the perceived risk associated with the Fed’s actions.

Remember, the crypto market is incredibly sentiment-driven. Fear, uncertainty, and doubt (FUD) can spread quickly, leading to rapid price swings. If the Fed meeting triggers a wave of FUD, a temporary dip to $60,000 is certainly within the realm of possibility.

Moreover, keep in mind that several factors can impact Bitcoin’s price, as shown by data in sources like Glassnode for on-chain analytics, that can influence its price such as halving events, mainstream adoption, and regulatory developments.

Navigating the Uncertainty: Strategies for Traders

So, what can you do to navigate this uncertainty?

- Stay Informed: Keep a close eye on the Fed meeting and any subsequent statements. Don’t rely solely on headlines; read the actual reports and analysis.

- Manage Risk: This is crucial. Don’t overextend yourself. Use stop-loss orders to protect your capital.

- Diversify: Don’t put all your eggs in one basket. Consider diversifying your portfolio across different cryptocurrencies and asset classes.

- Zoom Out: Remember the bigger picture. Bitcoin has shown incredible resilience over the years. Don’t panic sell based on short-term market fluctuations.

- Consider Dollar-Cost Averaging (DCA): Instead of trying to time the market, consider buying Bitcoin at regular intervals. This can help smooth out your average purchase price.

Key Takeaways:

- Fed Meetings Matter: The Federal Reserve’s decisions have a significant impact on Bitcoin and the broader crypto market.

- $60K is a Possibility: A hawkish Fed stance could trigger a sell-off, potentially pushing Bitcoin to $60,000.

- Stay Vigilant: Monitor the Fed meeting closely and be prepared for volatility.

- Manage Your Risk: Use stop-loss orders and avoid overextending yourself.

- Long-Term Perspective: Remember the long-term potential of Bitcoin and avoid making emotional decisions based on short-term market swings.

FAQs:

- Will Bitcoin definitely drop to $60,000?

- No one can predict the future with certainty. The $60,000 level is a possibility based on current market analysis and potential reactions to the Fed meeting.

- What should I do if Bitcoin drops to $60,000?

- That depends on your individual investment strategy and risk tolerance. Some investors might see it as a buying opportunity, while others might choose to wait and see.

- Where can I find reliable information about the Fed meeting?

- The Federal Reserve’s website is the best source for official information. You can also find analysis from reputable financial news outlets.

- Is Bitcoin still a good investment?

- That’s a personal decision. Bitcoin is a volatile asset, and its price can fluctuate significantly. Do your research and consult with a financial advisor before making any investment decisions.

- How often does the Fed meet?

- The Federal Open Market Committee (FOMC), which sets monetary policy, typically meets eight times a year.